Featured, Solutions

Discover the flexible options of Cartan Trade’s contracts

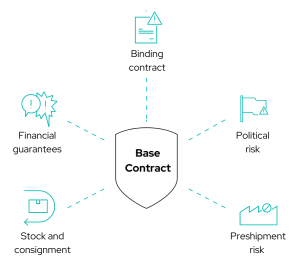

Did you know? Credit insurance policies include certain options to maximize your indemnification in the event of non-payment by your customers. At Cartan Trade, we’ve developed flexible contracts with clear, easy to understand options to enable you to take out the cover you really need.

Here’s an overview of the options available, to cover the different financial risks of your business, depending on the organization of your manufacturing and distribution chain. Contact us for more details or speak with your broker!

◆ Political risk coverage: if yo ur company exports, you may be exposed to political risk, to a greater or lesser extent depending on the countries you export to. What is this type of risk? Political risk arises when the government of a country prevents your customer from fulfilling its contractual commitments.

There are several cases that can be considered as political measures. For example, the enactment of a law blocking the transfer of currency or the conversion of local currency into the contract currency, an embargo on certain goods, or the declaration of war or conflict in your buyer’s country, preventing payment of your invoice.

◆ Cover for disputed receivables: in credit insurance contracts, unpaid invoices resulting from a dispute between you and your customer are subject to suspension of compensation, until the claim is recognized (amicably or legally). With Cartan Trade, you can take out an option to receive indemnification for the disputed receivable, as well as the legal and other costs involved in handling the claim, while the dispute is being resolved, within the credit limit in place.

◆ Binding contracts: This option cover binding contracts entered into with your customers, that commit you to future deliveries. In the event of a deterioration in their financial situation, your cover is maintained until the end of your binding contract period. This provision enables you to secure your cash flow through compensation in the event of non-payment at the end of the contract.

◆ Pre – Dispatch: The deterioration in the financial situation of one of your buyers, or even their filing for insolvency, can occur at any time during the business relationship. In some cases, default may occur after you’ve committed to a new production run, whether customized or not.

Taking out credit insurance not only protect you against unpaid invoices from your customers, but also gives you the possibility of being reimbursed for your costs of manufacturing the goods prior to delivery. By taking out the manufacturing risk option, the production costs of undelivered, non-reusable goods are included in the claim calculation.

Cartan Trade’s experts are available, along with your broker, to answer your questions and study your specific needs to secure your business development. Contact Us for more information!