Featured, Solutions

Gaining new markets, especially export markets, is a unique opportunity to develop your sales. But it’s not without risk for your company.

Starting a business relationship with a new customer, or increasing your sales with an existing one, requires special care and the implementation of “safeguards”.

Whether it’s an existing customer or a new one, when you’re dealing with an international customer, the financial information is more complex to obtain, the dunning and collection procedures more sensitive, and your knowledge of the economic environment murkier.

This is especially true as international payment terms extend over longer periods. This is a risk you need to be aware of before taking on a new market.

Transferring the risk

However, there are effective solutions for transferring this risk to a credit insurer, offering essential protection for the sustainable growth of your company.

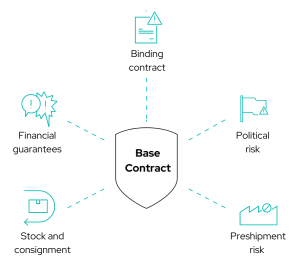

Unlock Focus allows you to benefit from complete support including information, risk monitoring, credit limit stability and collection, to secure a key transaction for your company. By opting for Cartan Trade’s Unlock Focus contract, your company is protected against the insolvency of the end buyer.

In the event of bankruptcy of the buyer during the period of manufacturing or in the event of non-payment of the goods on the due date of the invoice, your company is swiftly compensated by Cartan Trade, thus preserving your cash flow.

Being insured against unpaid invoices also gives your company the opportunity to benefit from optimised financing. Indeed, lending organisations are often more inclined to grant loans or credit lines when a transaction is covered by credit insurance.

Discover all the advantages of Cartan Trade’s Unlock Focus solution

In a nutshell, transferring the risk of non-payment to a credit insurer is an effective solution to increase your turnover with peace of mind in an unpredictable commercial environment, while protecting your company from financial losses due to customer non-payment. More info about Unlock Focus.

Unlock Focus is also available in a ‘Multi’ version to cover your outstanding amounts on your strategic customers, on a revolving basis over 12 months or in the event of business peaks when your internal credit limit is reached.