Press Area, Featured

Note from Christophe Pennellier, Senior VP & Chief Risk Officer at Cartan Trade, the insurtech democratising credit insurance, particularly for SMEs in Europe.

Cartan Trade stands out with its innovative and digitalized approach, offering modern and tailored solutions for businesses of all sizes. The company provides daily insights to European decision-makers, supporting and securing their business.

With over 30 years of experience, Christophe Pennellier plays a key role in risk management, contributing to Cartan Trade’s mission of making credit insurance more accessible and effective.

Today, Christophe shares his enlightened view on the current economic situation in France.

MAIN ECONOMIC TRENDS IN FRANCE

◆ French business leaders’ confidence took a hit in 2024. Ongoing uncertainties around public policies, budget issues, and the urgent need to reduce public deficits are placing considerable pressure on an already fragile growth outlook.

◆ Recent announcements on reducing public deficits (from 6.1% to 5% by 2025), coupled with cuts in public spending and increases in taxes, are expected to negatively affect both investment and consumption.

◆ In this context, France is under increased scrutiny from financial markets and rating agencies, driven by experts’ skepticism regarding the new deficit trajectory.

◆ French debt has become pricier with rising interest rates for government bonds (OAT), now surpassing those of Spain and Portugal. Notably, as of the second quarter of 2024, around 54% of French public and private debt securities were held by non-residents, making France particularly vulnerable to the perceptions and decisions of these foreign investors.

◆ The global context is filled with several geopolitical uncertainties: the upcoming elections in the United States, tensions in the Middle East, and the Russia-Ukraine war. This complex mix has significant repercussions on the French economy.

In this unstable economic environment, business leaders are in a wait-and-see approach and delay their investments.

FOCUS ON DIFFERENT SECTORS

The sectors where we do not anticipate any deterioration in 2025:

◆ The agri-food sector remains a cornerstone of the French economy. France is still recognized as an agricultural powerhouse, contributing significantly to national exports. Geopolitical tensions are adding pressure on agricultural prices. Meanwhile, climatic phenomena, such as El Niño and heavy rainfall disrupting the 2024 harvests, introduce risks that could affect an otherwise positive growth cycle.

◆ The energy sector needs significant investments to shift France’s energy mix, which remains too reliant on carbon (60% of consumption). Renewable energies are steadily increasing their share due to climate policies. The role of nuclear energy, accounting for 36% of the energy mix, provides France with internationally recognized expertise. Investments to modernize and expand the nuclear fleet offer promising opportunities.

◆ The pharmaceutical industry is experiencing a dynamic year in 2024, driven by innovation. International demand remains strong in this sector, dominated by “Big Pharma” companies like Sanofi. The development of social insurance mechanisms in countries that lacked them before the Covid crisis, offers promising opportunities. However, competition in the generics medication market is fierce.

For other sectors, we are facing high to very high risks.

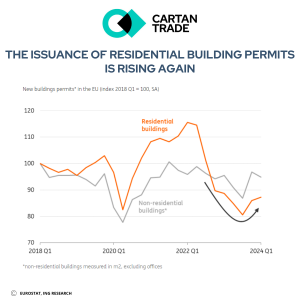

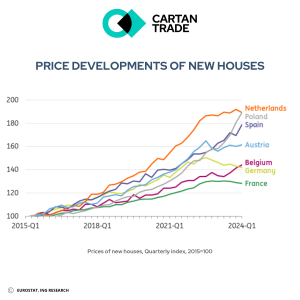

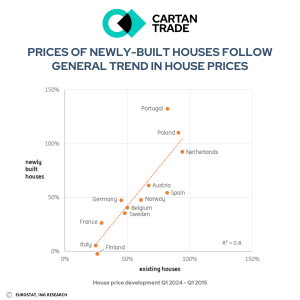

◆ The construction sector has been the hardest hit by the rise in failures over the past two years. Several factors explain the decline in new constructions and activities: high interest rates, a sharp decrease in land investments, difficulty for builders and craftsmen to pass on material and energy costs, and a drop in real estate transactions among individuals.

Initially, new housing was the most impacted by this slowdown, but now renovations are suffering as well, despite the significant need for thermal renovations and building upgrades. The instability of aid in this sector, with frequent changes in tax conditions and access to subsidies, along with their reduced attractiveness, deprives stakeholders to plan and initiate projects confidently.

Finally, the « Zero Net Artificialisation » (ZAN) policy limits and makes it difficult to initiate new projects. The demand for housing remains high in France. A decrease in interest rates along with a loosening of bank policies on home loans could provide some relief in 2025.

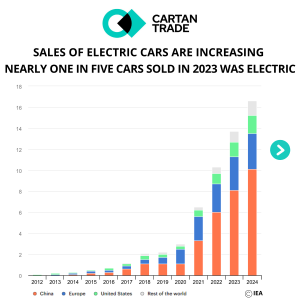

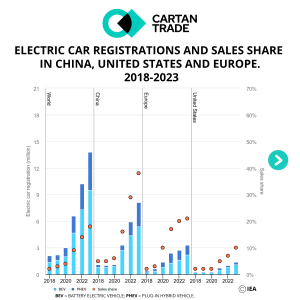

◆ The automotive industry is currently under pressure due to a significantly slowed market in 2024, with a drop in electric vehicle sales. This slowdown comes at a time when all manufacturers are dedicating a substantial portion of their investments to electric engines.

The 2035 deadline for banning the production of new combustion engine models is pushing automotive manufacturers to invest heavily in electric engines and adapt their industrial tools. The high cost of electric vehicles remains a significant barrier to their purchase. Additionally, implementing incentives and subsidies is complex, with frequently changing conditions that make buyers hesitant.

Additionally, Chinese competition in the vehicle market remains very aggressive. The customs barriers set up by Europe are effective for now, but China’s pressure and its desire to produce within the EU could weaken Brussels’ position.

The rising energy costs are straining the automotive sector, impacting bottom lines for 2024 and putting additional pressure on subcontractors. Many of them are already grappling with increased failures due to these cost hikes.

The reduction in interest rates, manufacturers’ latest efforts on electric vehicles, the need to decarbonize the automobile fleet, the renewal of product offerings, and the enthusiasm for vintage vehicles are all positive elements for the sector. However, the transition remains long and costly, especially under the increasing pressure from non-EU competition.

◆ The metallurgy sector is impacted by the difficulties of the Chinese economy, the world’s largest steel producer (55% of the steel produced in 2023). The real estate and construction crisis, the primary market for this steel production, has led China to massively export this steel, causing a sharp drop in prices since the summer of 2024. Steelmakers worldwide are being hit hard by these price drops during a period of industrial slowdown and significant investment needs (notably for decarbonization). Some players have already reduced their production capacity, and some have even ceased operations, such as Huachipato, Chile’s leading steelmaker.

Traders and resellers, who bought inventory at high prices, are now facing significant devaluations. This situation puts a strain on their financial stability.

The current economic context in France is uncertain. Growth is likely to continue slowing in 2025 due to unstable domestic policies and ongoing geopolitical tensions. This environment impacts both business leaders and households negatively, leading to high savings rates that detract from production.

INTERNATIONAL CHALLENGES FOR THE FRENCH ECONOMY

France’s position is challenged by its continuous failure to meet Eurozone convergence criteria. With none of the proposed plans hitting the mark, France is now under scrutiny for excessive deficits. Rating agencies have placed France on a negative outlook, and a downgrade would indeed increase debt costs. While the latest OAT issuances were well received, the widening spread with German rates underscores the rising debt burden.

Germany is a major economic partner for France and a key driver of the Eurozone. The slowdown in Germany, particularly due to decreased exports to China and Russia, poses a significant concern. Germany’s challenges are compounded by its strategic decision to phase out nuclear power, leading to higher energy costs and dependence on Russian energy. This, combined with its saving-oriented economy and demographic issues, creates a complex situation affecting the broader European economy, including France.

The international environment remains a significant factor of instability for 2025 forecasts. The upcoming US elections bring uncertainties, the ongoing conflict in Eastern Europe continues to be problematic, and persistent tensions in the Middle East threaten oil prices and disrupt international trade in the Gulf of Aden. Additionally, China’s economic recovery efforts and the growing pressure on Taiwan could become a new point of conflict, potentially destabilizing the electronics market.

On a more structural level, Europe is lagging in technological innovation behind the United States and Asia, particularly in areas like AI. The Draghi report highlights this gap and the potential risks, such as investment being diverted to more attractive regions and a brain drain of talent. The call for a massive EU investment plan underscores the urgency, but the divided stances among European countries, due to varying budgetary and debt situations, complicate the issue. This technological gap is a significant threat to Europe’s economic future.

INNOVATION: A DRIVER OF ECONOMIC RECOVERY

Innovation is often seen as a key driver for economic recovery because it shows that companies are optimistic about the future and willing to invest to meet new market demands.

However, it’s important to note that these investments tend to amortize slowly, making it a risk without guaranteed outcomes.

This delicate interplay between potential growth and inherent risk underscores why innovation is such a crucial, yet demanding, driver of economic recovery.

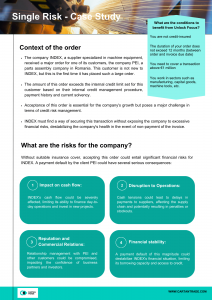

CREDIT INSURANCE: A LEVERAGE IN THIS CONTEXT

In recent months, we’ve observed an erosion of growth, a rise in failures across most European countries, particularly in France, and a recent study by the Banque de France reports a slippage in supplier payment terms, contradicting the LME law obligations.

In this context, credit insurance can provide a crucial visibility into the financial health of buyers and protection against unpaid invoices. This helps businesses secure transactions and navigate more smoothly in an uncertain economic environment, particularly useful in our current context.

Cartan Trade has a general underwriting policy that takes into account sector-specific micro-events and the situation of each company. It is essential in such circumstances to return to the fundamentals of cash management to protect one’s business.

After a period of enjoying low-cost credit access, it’s indeed crucial for businesses to return to sound cash management practices to ensure financial stability.

◆ This requires precise management of payment terms, which are deteriorating once again in France.

◆ After benefiting from state-guaranteed loans (PGE) and experiencing comfortable cash levels, companies now need to focus on securing their accounts receivable. This ensures liquidity and stability in financing their operating cycles, especially as payment terms in France are once again becoming more challenging.

◆ Finally, securing supplies during difficult economic times is crucial to maintaining operational continuity and minimizing risks.

Download the PDF version

Follow Cartan Trade on LinkedIn for more news