The landscape of automotive innovation has shifted over time. Since the invention of the automobile over a century ago, Europe played a pioneering but today has no longer its position of prominence.

Indeed, in the early 2000s, China decided to go electric. But it’s only in 2015 the European Continent began its transition, confronted with:

→ Volkswagen Emissions Scandal (Dieselgate),

→ Rising Environmental Concerns and the Paris Climate Agreement.

So today, the landscape for electric vehicles (EVs) is evolving, bringing both economic and political challenges.

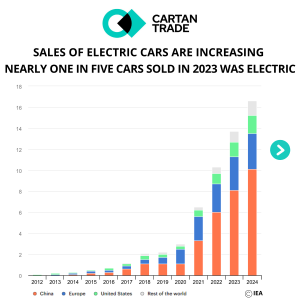

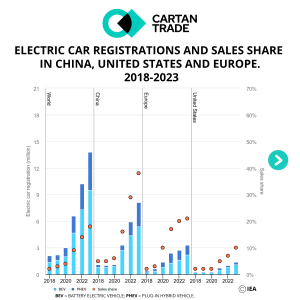

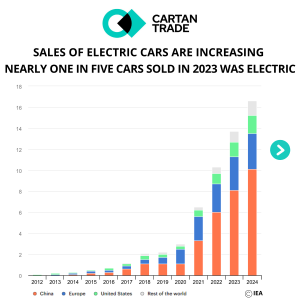

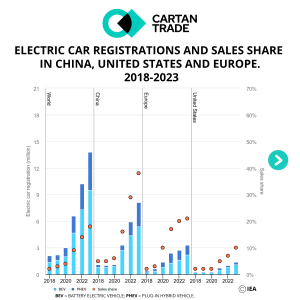

According to IEA, the surge in electric car sales during 2023 is impressive:

◆ Electric car sales are neared 14 millions.

◆ The total electric car stock reached 40 million.

◆ This growth represents a 35% year-on-year increase compared to 2022.

◆ The 2023 figure is over 6 times higher than the electric car sales recorded in 2018.

◆ 95% of which were: in China, Europe and the United States.

Compared with Western brands, Chinese EVs are more affordable. According to the European Commission, in the EU, Chinese EVs typically sell for 20% less than EU-made models.

After a 9-month investigation, the European Commission believes that China is infringing World Trade Organization rules, and has therefore decided to apply countervailing duties from 4th July, on imports of made-in-China vehicles of up to 38%, compared with the current 10%. Chinese BEV producers benefit from significant state subsidies, posing a threat to EU manufacturers.

The EU’s intervention follows the US’s decision to raise tariffs on Chinese electric cars from 25% to 100% a few weeks ago.

In a move aimed at ensuring fair competition and protecting its automotive industry, this new imposition of provisional countervailing duties on imports of battery electric vehicles (BEVs) from China, could spark a trade war. Indeed, Beijing has threatened to retaliate against European aviation, farmers and spirits makers.

So, both sides agreed to negotiate a possible compromise and have decided to engage in negotiations regarding planned import taxes on Chinese electric vehicles (EVs) in the European market.

These regions play critical roles in shaping the future of EVs. So it’s important for the EU to underscore the need for fair competition, environmental goals and strategic negotiations and avoid a trade war or economic retaliations, which would have repercussions for companies in the automotive sector, but not only